Part-1 in a four-part series on decentralized finance (DeFi) scams.

Many of us have fallen for some sort of scam. From shell games going at least as far back as ancient Greece to modern Ponzi schemes, there are always con artists hustling for money and victims thinking they can beat the game. We humans have a thing for fraud, and while technology changes rapidly people stay pretty much the same.

Fraud may be the oldest industry disrupted by cryptocurrencies and non-fungible tokens (NFTs). There’s no need to invent new schemes to heist huge cash hauls: crypto crooks are dusting off centuries-old, proven cons on the unregulated DeFi frontier. Insider trading, pump and dump, rug-pull, poop and scoop, wash trading, and even mundane fare like forgery and outright theft are all back and 10X more profitable than ever. We can use DeFi, like any tech, for good or for bad.

Grifters Are Jerks And Marks Are Not Innocent Victims

You need a few basic things to run a con. There’s the “Mark” or sucker – they’re the people who you’ll rip off. You must also win the mark’s confidence – you are “conning” them, after all. Finally, you need a plan to get away with the loot.

You also need a personality described as part psychopath, part narcissist, and part Machiavellian. You have no remorse, a gigantic ego, and you love manipulating people. Psychologists call these personality traits the “Dark Triad.” I call it being a jerk.

Marks help the swindlers with some psychology of their own: they tell themselves that they’re not the kind of person who would ever fall for a scam. Especially today, with so much information available online including “real customer” reviews we think that we can learn enough about a situation to avoid getting taken. Scammers know that: they guide us down the rosy path by making us feel smart and special.

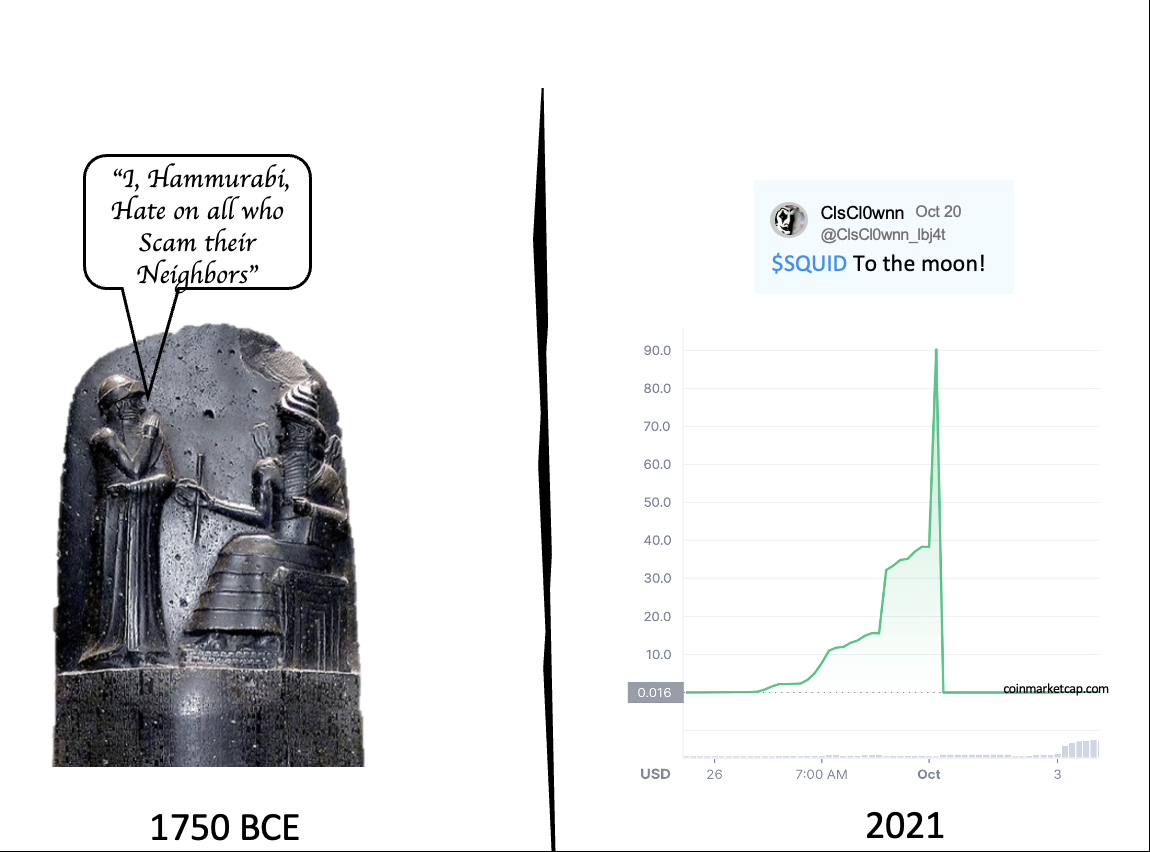

All of a sudden, a well-educated professional is raiding his kid’s college fund for a once-in-a-lifetime opportunity to buy Squid Games tokens. (We’ll look at the SQUID rug-pull in a later post. The sleazebags behind that scam vanished into the cyber ether with $3.3M in Mark, err, investor funds.)

When an obscure cryptocurrency’s value starts booming for no apparent reason we may sense a scam. However, with some web research and the hustler’s encouragement we convince ourselves that we not only understand crypto but we’re in fact one of the lucky few with a chance to get in on that token before it “goes to the moon.” We suspend a basic law of investing, “If it looks too good to be true, it is.”

The First Law of Marketing

There’s another bug in our psychological software, a back-door that grifters love to exploit. I call it the First Law of Marketing.

A smooth grifter charms the Mark’s brain to light up with glee, “It’s true! I knew it!” Camel Cigarette ads in the 1930’s told nicotine addicts that smoking improved digestion. “Yes! I knew that smoking was good for me!”

Self-confident modern Marks hand over real money for forged NFTs, non-existent digital tokens, and cryptocurrencies that boom only because a hustler slides massive volumes of coins back and forth among his own accounts. Boom!

Grifts have been run throughout all recorded history.

The First Documented Fraud

An ancient written legal framework, Babylonian King Hammurabi’s Code from ~1750BCE, has plenty of points covering fleecing thy neighbor; fraud was definitely a thing along the Euphrates. Maybe the oldest well-documented scam comes from Greece in around 300BCE.

Hegestratos, a merchant, floated a scheme for making some easy money. He took out a loan and promised to pay it back with interest after sailing cargo of grain from Syracuse to Athens. The lender would get both the boat and the grain if Hegestratos didn’t repay the loan. Hegestratos had a Mark, a lie, and a plan: he would sink the ship, keep the money, and never look back.

Even better, instead of buying grain he would take paying passengers and keep their money, too: genius! Sadly for Hegestratos, his getaway plan failed. The passengers and crew caught him trying to scuttle the boat with them on board and got really ticked off. Hegestratos drowned trying to get away, and there is no record of what happened to the cash. Hegestratos would have done much better running a shell game.

Before Hegestratos and forever after, in every culture and every country con artists have ripped people off and slithered away with the money. Even one of America’s “Founding Fathers” ran a national grift. It was a classic example of a basic financial scam: insider trading.

The Founding Father of American Insider Trading

Compared with other hustles, insider trading takes little creativity or effort. All you need is access to valuable information that the Marks – whoever is on the other side of your trade – don’t have. A great way to get that access is landing the right job.

When George Washington was sworn in as the first President of the United States in 1789, he got right to work and cemented his legacy as the Father of his country. William Duer got right to work on his own legacy as the Founding Father of insider trading. Duer was a social climber and a jerk. George Washington gave away the bride at Duer’s wedding. Alexander Hamilton became a close friend, and Duer convinced Hamilton to make him the first Assistant Secretary of the Treasury. Top-flight grifters have a knack for ingratiating themselves with uber-credible famous people.

The young nation was a sketchy credit risk. Imagine running a big trading company’s treasury and thinking about where to invest your cash. Here’s how your thoughts might run. “Hmmm, bonds issued by the former colonies. The United Kingdom’s ruler, George III, hates their guts and controls the shipping lanes. Spain has garrisons all along their southern border. The natives up and down their western border hate their guts, too. Oh yeah, all those British loyalists who fled north to Canada: they’re pretty chapped. And that brand-new constitution… Well, it’s supposed to make their central government better at financing stuff but I don’t want to be the first to see how it works.” You’d demand interest rates like a pay-day lender.

Hamilton made improving U.S. government bond quality a top priority so that big financiers would act more like banks and less like pawn shops. One key was replacing old colonial bonds, mainly used to finance the revolutionary war that got King George III so mad, with bonds backed by the new U.S. federal government. An old colonial bond’s value would skyrocket with a replacement announcement. William Duer knew exactly which colonial bonds were being replaced and when. Before an announcement, he bought every soon-to-be-replaced bond he could lay his hands on. He was a colonial bond vacuum cleaner. Duer spent his own money, he spent borrowed money, his friends spent their money, and they all got rich.

But scammers, being narcissists, never feel rich enough. Duer left the Treasury in 1790 to focus full time on using his connections for insider trading on U.S. bonds and, later, shares in the new Bank of the United States. His getaway plan was simple: insider trading was totally legal.

The market caught up to Duer in 1792 when plunging Bank of the United States shares, which he borrowed even more money to scoop up, nearly bankrupted him. His speculation was huge: it was as if all of New York’s big investors suddenly gaped at each other, “Oh crap: Duer owes me money, too!” It ignited an all-out financial panic.

Insider trading was legal, but being a deadbeat was not: Duer landed in debtors’ prison. In April 1792, Duer looked down from his shared cell in Lower Manhattan’s infamous New Gaol as crowds gathered outside, literally calling for his head.

Determined to not let a good crisis go to waste, a month later a group of Duer’s still-solvent Marks met under a buttonwood tree in Manhattan. They agreed to trade only among themselves in the future, and their trading club became the New York Stock Exchange.

Duer died in debtor’s prison in 1799 at age 56. I don’t feel sorry for him.

Insider Trading Becomes Illegal in The Great Depression

Insider trading boomed in the U.S. stock market in the 1920s. It helped drive soaring prices that led to the infamous Black Monday crash of 1929 and the ensuing ten-year Great Depression. Albert H. Wiggins, the head of Chase Bank, scored big-time by shorting his own bank’s shares.

Knowing that financial Armageddon was coming Wiggins shorted 40,000 Chase shares, a huge bet against the bank that he was running. The crash happened and Wiggins pocketed $4 million on the trade – that’s $40million in today’s money. It was 100% legal. While millions of average investors lost everything they owned, Wiggins and other jerks lived out the depression in pampered luxury.

All an inside trader needs is a trusting employer and a screw-you attitude toward everyone else. Thanks to the Duers and Wiggins of the world, insider trading has been massively illegal on United States exchanges since 1934. It’s called regulation.

But crypto and NFTs aren’t really stocks, bonds, or commodities, so they’re not really regulated. What could possibly go wrong? Insider trading is rampant in DeFi. People are making a ton of money on it, and no one’s going to jail.

A Crypto Insider

One of the latest crypto insider trading deals was pulled off by an employee of the biggest NFT marketplace, OpenSea. OpenSea is an online digital art gallery, a global Grand Bazaar where digital art creators and collectors meet to buy and sell. Stories of digital artists banking tens of millions of dollars on pixelated pictures that, to me, look like they were done by First-graders have lured millions of so-called artists to generate even more First-gradish art. It’s tough to stand out in the competitive First-grade art crowd. This stunning lady does; she’s a Crypto Punk:

on OpenSea.”

One of the best ways to get attention in the churning digital art ocean is appearing on OpenSea’s home page. Prices often soar for pieces posted to that high-profile location.

Last September an enterprising OpenSea employee, the Head of Product no less, had inside information, crypto accounts, and a plan (allegedly). According to multiple reports, knowing when a digital art piece would appear on OpenSea’s home page he’d buy it then flip it for a tidy profit. If he were alive today William Duer would probably be trying to get in on the action.

OpenSea immediately assured users in a blog post that “…this behaviour does not represent our values as a team.” Aww, that wasn’t that nice of them to say? The employee soon parted ways with OpenSea but kept his real-world freedom and, presumably, the loot from his virtual-world scheme.

Real-World Scam, Real-World Consequences

The very same day those slithery trades became public, September 15, 2021, another enterprising young man also thought he had scored big with inside information. But he acted in the real world and suffered real-world consequences.

A partner at the prestigious consultancy, McKinsey, ran a project for his client, Goldman Sachs. Being a McKinsey partner working on Goldman Sachs is consulting’s Premiere League. This guy was not short of cash, prestige, connections, or career opportunities. But he needed more, and he latched onto a quarry that he couldn’t swallow.

He advised Goldman to buy a publicly traded finance technology company, GreenSky, Inc. He loaded up on GreenSky call options right before the September 15, 2021, public deal announcement and netted $450,000. But it’s not 1929, and the Securities and Exchange Commission, the SEC, swoops down on inside traders like a hawk.

Public companies teach employees, especially their executives, a mantra about insider trading: “The SEC will catch you. The SEC will catch you. The SEC will catch you.” And caught he was, and convicted, and sentenced in April 2022 to two years in jail followed by deportation to his native India.

The maximum criminal penalty for insider trading on securities in the USA is 20 years in prison and a $5,000,000 fine. Meanwhile, insider trading of NFTs is completely legal.

In Crypto, it is All Low-Hanging Fruit

Insider trading is not the only low-hanging fruit of DeFi fraud. In that unregulated no-real-consequences world, it’s all low-hanging fruit. Next time we’ll look at the crypto era revival of two old favorites with catchy names, Rug Pulls and Pump-and-Dumps.